Kahn Brothers, a renowned expense administration agency, has extended been synonymous with experience and good results in the financial globe. With a celebrated heritage spanning many many years, they have constantly shipped remarkable returns to their clients by way of their astute expenditure approaches. Started by famous buyers Irving Kahn and his two sons, Thomas and Alan, the firm has constructed a sterling status for their exclusive insights and meticulous study. Let us delve into the wonderful investing knowledge of Kahn Brothers and uncover the strategies powering their impressive observe document.

one. Track record of Kahn Brothers

Kahn Brothers is an expenditure management organization that was founded by renowned buyers Irving Kahn and Thomas Graham Kahn in 1978. The agency, dependent in New York Town, is acknowledged for its long-expression worth investing strategy and has developed a sound reputation in the fiscal business.

The Kahn Brothers’ investment philosophy is rooted in the rules of Benjamin Graham, who is extensively regarded as the father of worth investing. The company focuses on determining undervalued securities and companies with strong fundamentals, aiming to produce steady returns more than time.

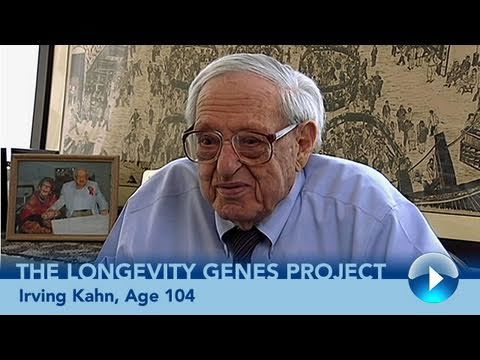

Irving Kahn, usually deemed one particular of the pioneers of benefit investing, played a substantial function in shaping the expenditure approach of Kahn Brothers. He worked closely with Benjamin Graham and was a disciple of his teachings. Irving Kahn’s in depth knowledge in the financial marketplaces, spanning a number of many years, tremendously contributed to the good results and reliability of Kahn Brothers.

These days, Kahn Brothers continues to be a trusted title in the subject of worth investing, adhering to its time-tested method even though also incorporating modern day expenditure techniques. With a determination to preserving and growing their clients’ cash, Kahn Brothers has gained the respect and admiration of investors around the world.

two. Investing Philosophy and Approaches

Kahn Brothers, launched by Irving Kahn and his brothers, is renowned for its special investing philosophy and approaches. With a focus on worth investing, the company has been capable to achieve impressive achievement in excess of the years.

One essential facet of Kahn Brothers’ investing philosophy is their emphasis on locating undervalued shares. They think that by very carefully analyzing the fundamentals of a company, they can determine shares that are investing at a price reduced than their intrinsic worth. This approach allows them to target investments that have the prospective for substantial long-term gains.

One more noteworthy approach utilized by Kahn Brothers is their prolonged-term investment decision horizon. They have a individual strategy when it arrives to investing, usually keeping positions for numerous years. This technique is rooted in their perception that by offering undervalued organizations adequate time to recognize their potential, they can generate sizeable returns for their investors.

In addition to their benefit-oriented approach, Kahn Brothers also focuses on danger administration. They actively seek out to reduce threat by conducting comprehensive research and examination just before making any expenditure selections. This meticulous method will help them to identify likely pitfalls and mitigate danger factors.

General, Kahn Brothers’ investing philosophy and methods revolve around tolerance, benefit, and threat management. Their concentrate on locating undervalued shares and holding them for the prolonged phrase has verified to be a profitable system, generating them a highly regarded title in the investment decision planet.

three. Notable Investments and Accomplishment Tales

Kahn Brothers, known for their astute investment decision approaches, have an remarkable keep track of report of productive ventures. kahn brothers advisors Let us take a closer seem at a few notable investments that have contributed to their track record as shrewd buyers.

Acme Widget Business: 1 of Kahn Brothers’ most impressive achievement stories is their expenditure in the Acme Widget Firm. Recognizing the firm’s potential for development in the booming tech market, they strategically acquired a considerable stake in Acme. Their foresight paid out off handsomely, as Acme Widget Company went on to turn into a market place leader, offering remarkable returns for Kahn Brothers and their investors.

International Vitality Corp: An additional expenditure that showcases Kahn Brothers’ expertise is their involvement in Worldwide Energy Corp. Recognizing the increasing demand from customers for renewable energy resources, they discovered the possible of this forward-thinking organization in the clear power sector. Their early investment authorized World-wide Vitality Corp to grow its operations and capitalize on the increasing market, ensuing in important profits for Kahn Brothers.

Stellar Prescription drugs: Kahn Brothers’ investment in Stellar Prescription drugs is however another achievement story with extraordinary returns. By meticulously analyzing the healthcare business, they discovered the possible of this progressive pharmaceutical company. Their strategic investments served Stellar Prescribed drugs provide groundbreaking medications to industry, top to substantial income and cementing their standing as competent traders.

By unveiling these and several other spectacular investing insights, Kahn Brothers have unquestionably produced their mark in the financial globe. Their capacity to determine promising possibilities and make strategic investments has regularly yielded remarkable benefits, earning them a nicely-deserved reputation as one of the most successful buyers in the industry.